05 Jul 2020 When extending payment terms does more harm than good

If you want to get from A to B as cheaply as possible, you’d select the cheapest type of fuel for your car. If you want to win the race, you’d choose the best fuel – the cost wouldn’t come into it. So why do businesses hand over the driving seat to accountants?

This is unfair to accountants. Real life business is profit conscious and therefore cost conscious. If you pay no regard to costs you won’t compete on price. And this is why the subtleties of payment terms is relevant to buyers. The headline price of a product isn’t enough to consider – it’s not the only the price – the cost of payments need to be included too. After payment has a cost associated with it.

Why do businesses hand over the driving seat to accountants?

But that doesn’t mean that late payment is always a good option and neither is it always a practical possibility. Some products and services require advance payment (training courses and conferences for example) and some suppliers can’t support extended payment terms. If you need a specialist product that is manufactured exclusively by a small family business that requires 7 day payment term to survive – that’s the basis on which you need to do business with them. You can of course encourage them to use a factoring service but that adds cost to the supply chain.

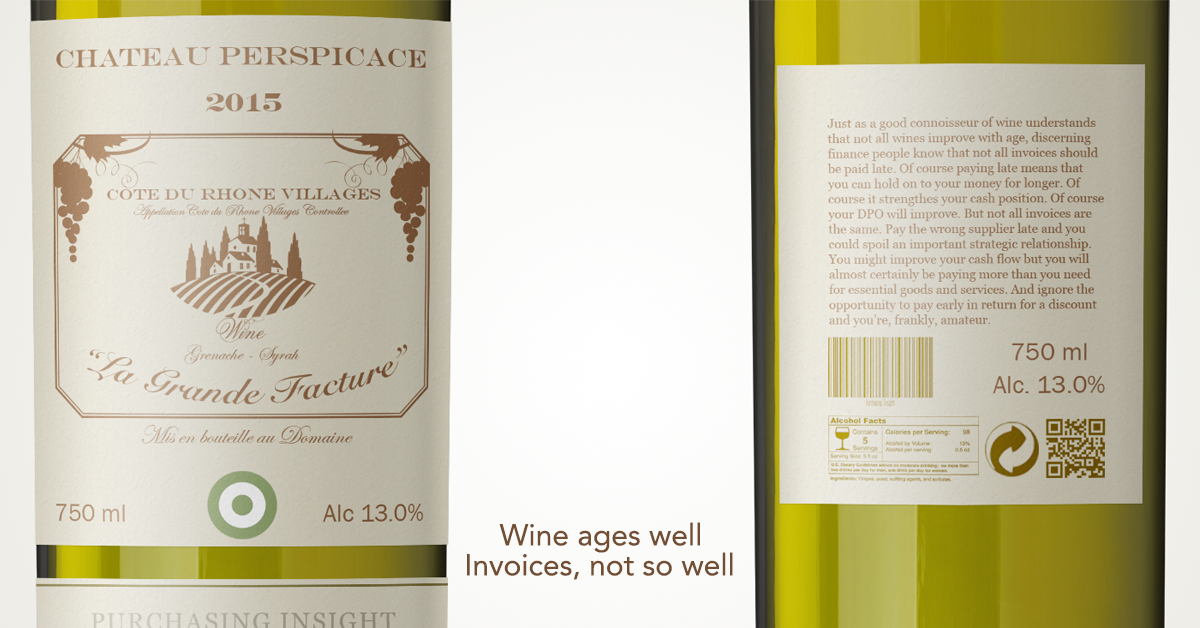

None of this is ground breaking and neither is the revelation that opposite ends of the purchase to pay chain forget these basic principles every day. Buyers negotiate short payment terms without regard to the ability of their business to support them and finance people remain fixated on paying as late as possible regardless of whether that introduces unnecessary costs or whether it damage a strategic supplier relationship.

Buyers and finance people need to become more rounded. They need to understand each others’ points of view and to an extent, learn each others’ jobs. The buyer should intuitively know the inherent commercial cost of short payment terms just as the accountant need to learn the strategic importance of early payment of some specialist suppliers. It is why a business does not (or should not) standardise on a single payment term.

It’s amateurish for an accountant to develop a fixation on extended payment terms and increased DPO and it shows lack of commercial awareness. And so too is it amateurish for buyers not to recognise the limitations of the purchase to pay cycle, what is possible and what is desirable when it comes to payment terms.