29 Aug 2012 Supply chain finance – a game changer

We’ve always seen the banks as being the facilitators of commerce. Depending on your point of view, they’re an invaluable support to business or a necessary evil. Without a properly regulated banking industry, business in the modern world couldn’t function.

Or could it? There are changes happening that could make us question what role the banks play and in some industries and supply chains, there could be a better way.

Consider for a moment how businesses fund themselves. A manufacturer for example, buys raw materials, tools and equipment and employs people to make goods which it sells to customers. Those customer, after some time, pay for those goods. During that delay between supply and payment, the manufacturer still has costs to cover: further supplies, overhead costs and wages. Unless the company is cash rich, the working capital required to keep the business afloat is provided by a bank.

Consider for a moment how businesses fund themselves. A manufacturer for example, buys raw materials, tools and equipment and employs people to make goods which it sells to customers. Those customer, after some time, pay for those goods. During that delay between supply and payment, the manufacturer still has costs to cover: further supplies, overhead costs and wages. Unless the company is cash rich, the working capital required to keep the business afloat is provided by a bank.

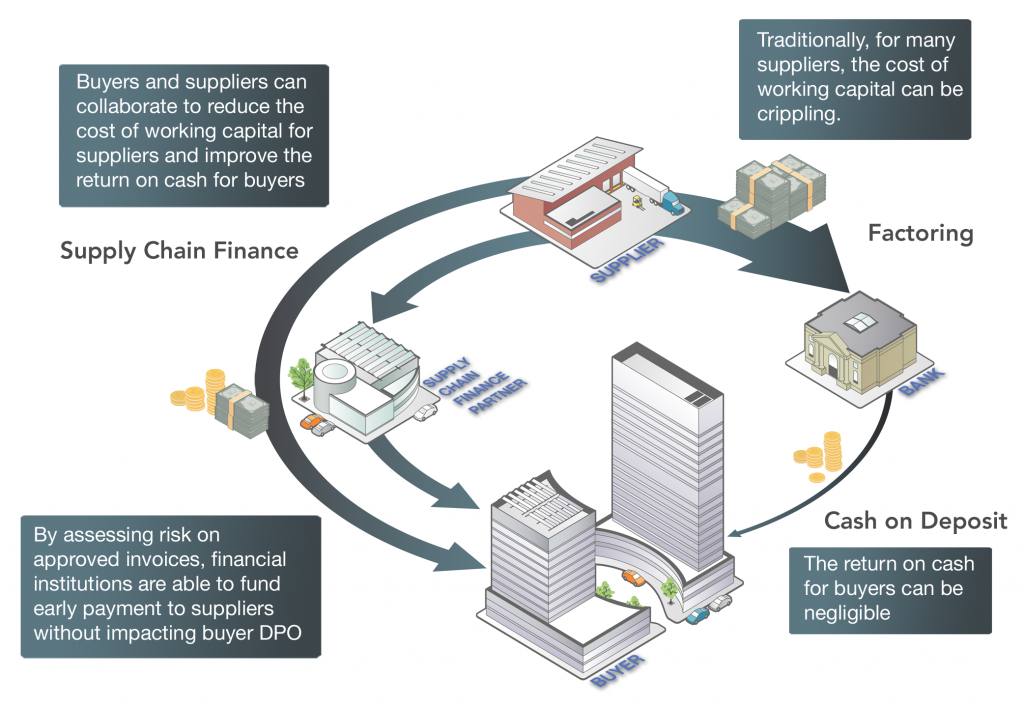

The cost of working capital varies greatly and it generally depends on the financial standing of the business. It is quite common for businesses to use their outstanding invoices as collateral to secure finance. This effectively gives them early payment on those invoices but at a price. It is not unusual for a bank to charge 2-3% of the value of an invoice. In annual percentage rate terms, this method of factoring invoices can mean the cost of working capital can be in excess of 20%. In contrast, buyers are able to reduce their costs of working capital by delaying payment but at as time when interest rates are very low, even cash rich businesses struggle to get a more than 1% return on their cash.

But take a step back and look at the overall cost to the supply chain. The net cost to the supply chain in this scenario is 19%. That’s the cost that leaks from the supply chain using traditional ways of doing business. There has to be a better way and, as many businesses are finding out, there is.

By collaborating directly, buyers and suppliers can effectively plug the financial leak in the supply chain and share in the reduced cost of doing business. Suppliers can offer discounts for early payment that create a win-win for all parties or, by assessing risk based on approved invoices, financial institutions can fund early payment without impacting the buyer’s DPO.

It is no exaggeration to say that supply chain finance, in the forms that are emerging currently, is a game changer and that new game doesn’t involve the banks. Banks are already being side-lined as businesses seek and find ways to disintermediate them. But it’s not all good news for business. The sad fact is that most business don’t qualify to play this game.

However attractive it is to take out 19% of cost from their supply chain this is only possible where trading partners are already in a position to trade efficiently. To pay promptly, you need to be in a position pay promptly. That means having efficient purchase to pay processes in place. It means having an accounts payable department geared up to turn invoices around quickly and it means that the business objectives of the finance team are properly aligned with that of procurement to understand the compelling benefits of financial supply chain management.

Achieving any of the benefits of supply chain finance with pieces of paper is fanciful and suppliers and buyer alike need to ensure that e-procurement and e-invoicing are seen as business as usual technology. These technologies should be taken for granted not feared or put off for another day because without them, 19% will continue to leak from the supply chain.

Pete Loughlin can be found on twitter @peteloughlin