e-invoicing may be flavor of the month in some quarters but despite having been practiced by some of the largest organizations in the world for over a decade it remains in its infancy. Estimates vary but only about 15% of the world's invoices are transmitted electronically and the level of adoption across the globe varies tremendously. In some countries, despite the approval of the tax and regulatory authorities, take up by business has been slow while in other parts of the world, it is governments' reluctance to accept e-invoicing that is acting as a blocker.

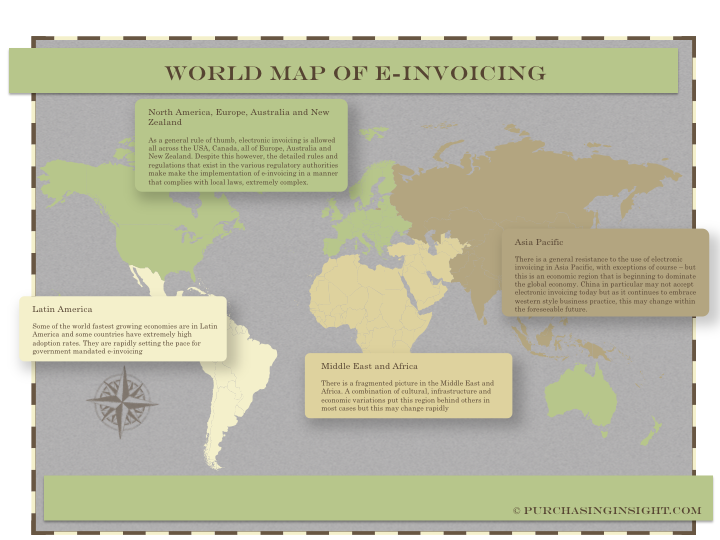

The world map of e-invoicing

The world can be divided into four e-invoicing regions. North America and Europe together with Australia and New Zealand, Latin America, Asia Pacific and Middle East and Africa.