In response to a witty remark by the artist James Whistler, Oscar Wilde declared “I wish I'd said that”. Quick as a flash, Whistler replied "You will Oscar, you will".

I often think to myself "I wish I'd said that" especially whenever I read anything by Seth Godin. He distils wisdom into the most straight forward and frighteningly obvious observations. That's why he's a genius. The title of his book Purple Cow is one such example. The purple cow is the one that stands out from the crowd, the one that differentiates itself. This, Seth preaches, is what businesses need to do to promote themselves. Mostly, they don’t.

I’m not a marketer but I’m a seasoned marketee and from this side of the fence I can tell you, there is something wrong with the way B2B solution providers try to get their message out.

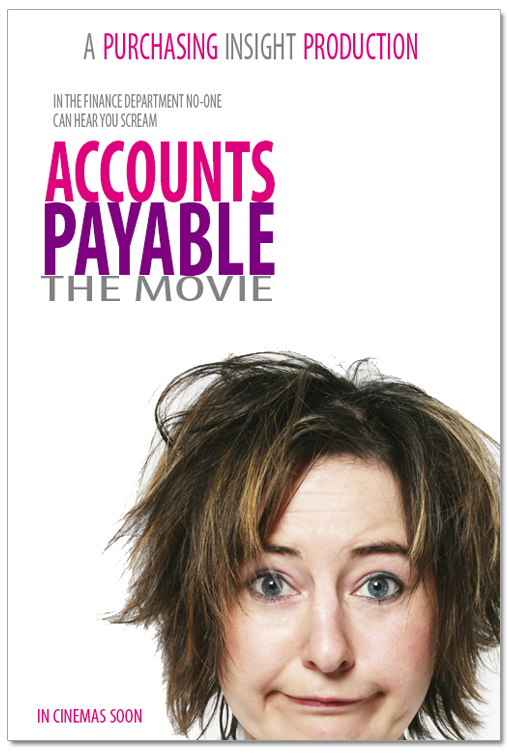

Imagine you're a casting director for a new Hollywood movie about Accounts Payable. I know what you're thinking - a movie about Accounts Payable isn't going to break any box office records - but you never know. Given the right characterization and a decent plot it could work.

So who would you cast the AP protagonist? Who could embody accounts payable? Are they young or old? Male or female? Are they attractive or plain? Sexy? Heroic? Timid? Tall? Short? What does a stereotypical AP person look like?

9 times out of 10 you'd say it would be a woman and 10 times out of 10 you'd say they were a little bit crazy.

A little bit crazy to say the least. It's true, AP people are nearly always women and nearly always wired in a way that the rest of us don't understand. They memorize dozens, sometime hundreds of account numbers, cost centers and general ledger codes and they get pissed off when the rest of can't remember them all too. But contrast that with the stereotypical purchasing person. How would finance people cast a procurement person in the movie?

Imagine you're a casting director for a new Hollywood movie about Accounts Payable. I know what you're thinking - a movie about Accounts Payable isn't going to break any box office records - but you never know. Given the right characterization and a decent plot it could work.

So who would you cast the AP protagonist? Who could embody accounts payable? Are they young or old? Male or female? Are they attractive or plain? Sexy? Heroic? Timid? Tall? Short? What does a stereotypical AP person look like?

9 times out of 10 you'd say it would be a woman and 10 times out of 10 you'd say they were a little bit crazy.

A little bit crazy to say the least. It's true, AP people are nearly always women and nearly always wired in a way that the rest of us don't understand. They memorize dozens, sometime hundreds of account numbers, cost centers and general ledger codes and they get pissed off when the rest of can't remember them all too. But contrast that with the stereotypical purchasing person. How would finance people cast a procurement person in the movie?