11 Jul 2012 Supply chain leakage – stemming the flow of costs

When you calculate the scale of costs that leak from the supply chain, it reveals astonishing waste and it’s time that businesses – supplier sand their customers – took a closer look at collaborative techniques to take out these pointless costs.

It may be seen as being within the domain of the accountants yet sourcing professionals will, even if they are not aware of it, play a key role in the management of working capital.

It may be seen as being within the domain of the accountants yet sourcing professionals will, even if they are not aware of it, play a key role in the management of working capital.

Payment terms negotiated and agreed as part of any supplier contract define the target DPO for an organization and they have a direct impact on the organization’s cost of working capital.

But for the procurement community, payment terms can be a double-edged sword. While it’s good to contribute to the reduced cost of working capital by extending payment terms, this doesn’t always support healthy supplier relationships and it can put an inordinate strain on the finances of the supplier, which is in the interests of neither party. It can be a very difficult balancing act.

But there is another, more compelling reason why the traditional approach to working capital management doesn’t make sense from a procurement point of view. It costs a fortune! The fact is that the traditional, siloed, adversarial approach adopted by most buying organizations toward their suppliers has a huge supply chain cost especially in the current economic climate.

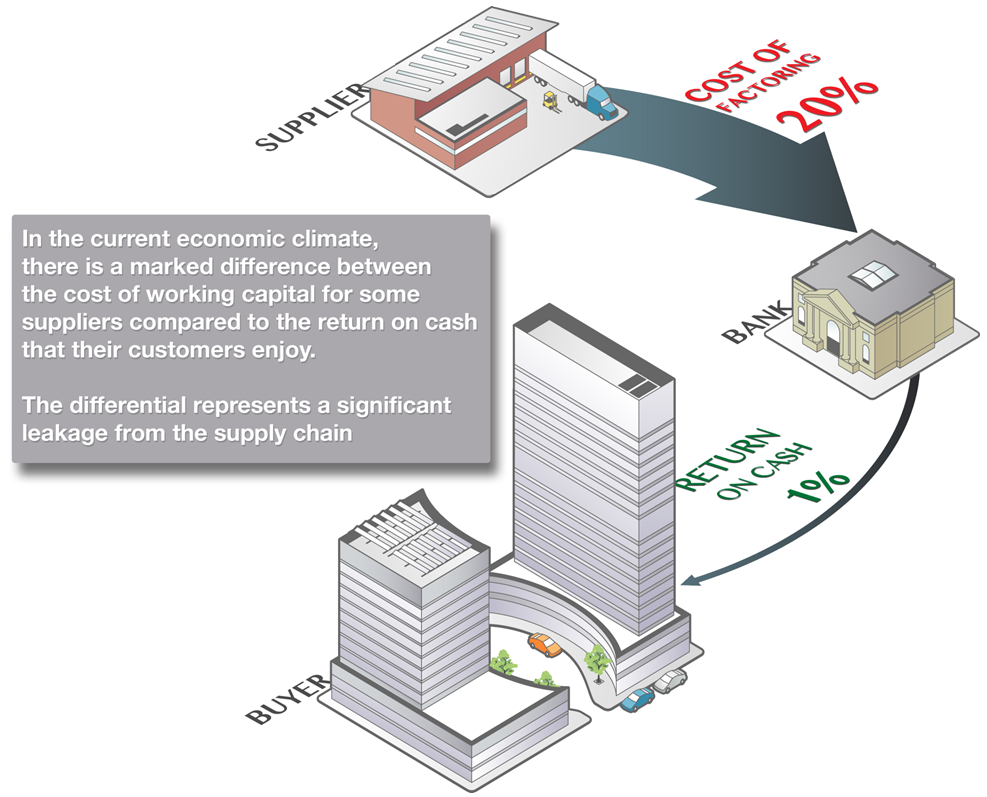

There is a wide variation in circumstances but even very large, cash-rich organizations struggle to get more than 1% on cash. Paying suppliers late and extending payment terms for a further 30 days for example gains them a paltry 0.08% return. In contrast, their supplier may have to pay a high cost to cover that extra period. Although a typical factoring cost may be in the region of 2%-3%. That’s well in excess of 20% on annual interest rate terms and some factoring firms will charge as much as 6% of the value of invoices for early payment.

Supply chain leakage

Take the example of a large, cash-rich buying organization getting 1% return on capital dealing with a supplier being charged at an annual rate of 20% for credit. This is not atypical and for any given buying organization, they may have many such suppliers. In terms of working capital, the cost of doing business for these organizations is 19%. That’s the cost to the supply chain and one way or another, that cost is hitting every organization in the chain – upstream and downstream.

The numbers in the example are arbitrary and approximate but by no means unusual. Regardless of the exact numbers, the fact remains that the supply chain model that necessitates a supplier to fund increasingly delayed payments is a highly costly model that allows significant leakage of money from of the supply chain into the hands of the banks.

Is this an issue that the procurement function should address? Compare it with other types of costs. If there’s an onerous tax regime in one country, it is quite normal to establish sourcing and supply chain models and strategies that eliminate those tax costs by avoiding that territory. This is part of the value that a mature procurement organization adds and it should be no different for financial supply chain costs.