07 May 2012 Supply chain finance – are you ignoring your greatest source of saving?

Supply chain finance is increasingly seen as a source of significant saving. By using supply chain finance tools and techniques, whether that’s simply managing payment terms better or whether it is by using more sophisticated techniques like dynamic discounting or reverse factoring, significant commercial benefit can be derived. Treasury managers are taking it more seriously but in many cases they are ignoring one of the biggest sources of saving and it’s right under their noses.

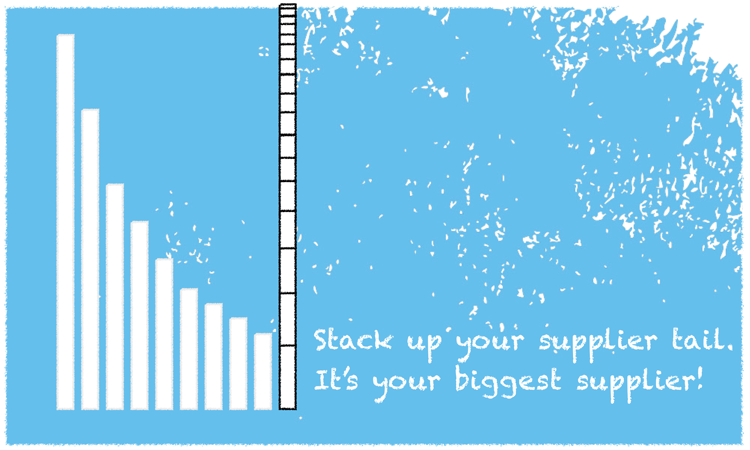

Map your organization’s suppliers by value of spend and it’s easy to see why most of your spend is with a small proportion of suppliers. It’s a typical 80:20 with 80% of spend with 20% of suppliers and classically, it’s within the 20% of the largest suppliers that there is most return to be derived from spend management.

Map your organization’s suppliers by value of spend and it’s easy to see why most of your spend is with a small proportion of suppliers. It’s a typical 80:20 with 80% of spend with 20% of suppliers and classically, it’s within the 20% of the largest suppliers that there is most return to be derived from spend management.

But take a step back for a moment and compare the “tail”, the 80% of suppliers that represent 20% of spend, with your other suppliers. When you aggregate the tail spend it often proves to be amount to more than your biggest suppliers.

Your supplier tail could be your most important supplier!

So if the tail spend exceeds that of your bigger suppliers, why is it ignored? Of course it’s more complex. Engaging with multiple small suppliers is very different than with a smaller number of large suppliers. But this is 2012 and in the era of “big data” management there are tools and techniques available to support even the most complex supplier landscape.

I recently spoke to Sid Vasili, CEO of Invapay, who specializes in helping businesses managing their tail spend. “Lots of organizations are adept at extracting value from their core spend.” Sid told me. “Indeed for many, they’ve already squeezed out most of the benefit that’s available. Ignoring tail spend is potentially leaving huge amounts of money on the table.”

There is nothing wrong in focusing attention where it gives the greatest reward but, particularly for mature organizations, when major supplier spend has been optimized the significant benefits available from managing tail spend could be a new and as yet untapped source of savings.

To learn more about managing supplier tail spend more effectively, download the white paper “Supply Chain Finance – extracting value from the supplier tail”