Purchase to Pay

19 Jan Purchase to Pay and the challenges of matrix management

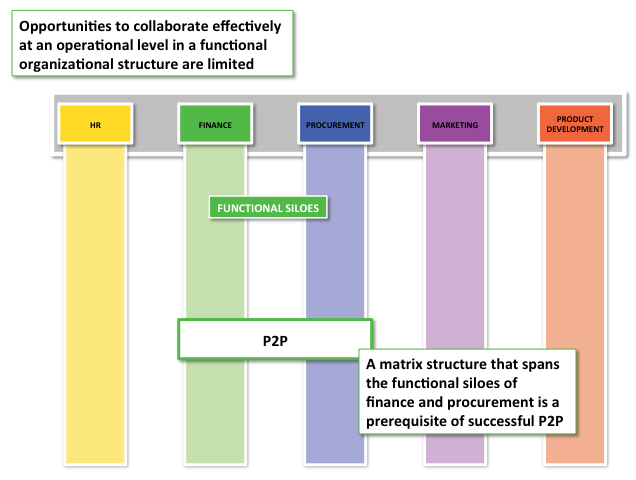

Ask anyone who knows what they’re talking about - go to any conference on Purchase to Pay and you’ll hear the same thing: The biggest challenge to making P2P work is the disconnect between finance and procurement. I’ve commented on it many times. There are fundamental differences between the way finance and procurement see purchase to pay and getting alignment is not straight forward but there’s another reason why, for some organizations it is a challenge and that is their organizational structure.Managing P2P in a matrix

To someone in an functionally structured organization, it doesn’t seem unusual. Indeed, if you are used to working within a functional silo, to operate in a matrix environment would seem daunting. How can you serve two masters? How can competing priorities be managed? In contrast, those that operate in matrix organizations view siloed businesses with some disdain. The term “silo mentality” is never used as a compliment. But sometimes, silos are sensible or at least non-negotiable and when that’s the case, the task of implementing P2P is especially challenging.

27 Dec Purchase to Pay Perspectives

In many organisations, purchase to pay is like a car crash. Like something dreadful – something that despite yourself, you can’t stop watching. Unbelievable. Horrific. Shocking even. Yet compelling. Alright, perhaps not quite that bad - but it can be pretty bad. I also mean it’s like a car crash in the sense that if you ask a few witnesses what they saw, they’ll all tell you something different. It's like they’re describing completely different events. It’s something I’ve written about before – the wide variety of views that people have of the same thing depending on their perspective. Finance people see P2P as an opportunity to account for things more accurately. Purchasing people see it as an opportunity to make savings through compliance and, indirectly, through better spend analysis to get better value for money. Ask a P2P operations person, they’ll tell you it’s about better process and straight through processing. They’re all valid perspectives and they are all correct but I have a question. Which perspective delivers the biggest benefit and more importantly, which is the one that will persuade a board to invest in P2P? In other words, what is the real business case for P2P? It's not what you might think.16 Dec What’s the point of Purchase to Pay? Ask Nipendo

22 Nov Anti-social corporate behaviour and the price of poor P2P compliance

Would you impose purchase to pay policies on people in your organization if those policies, whether followed or not, have no real consequences? Think about it – if someone goes off piste and buys some stationery from a non-preferred supplier and expenses it – a few dollars in a few billion dollars of spend – are you really going to crack down on them? They’re going outside of a policy and they know it. Interpreted strictly, they’re breaking the rules and they could be disciplined for such behaviour. Should we develop a sense of perspective? What difference does this behaviour make?14 Nov Israel Aerospace Industries (IAI) automates its entire procure-to-pay process

Israel Aerospace Industries (IAI) has revealed it is now managing its entire procurement and financial activities with its suppliers in a paperless and automated environment.

Over 3,000 suppliers exchange over 20,000 documents each month – from RFPs through purchase orders and invoices to payment confirmations – creating an efficient and environmentally-friendly process with saving of up to 50% in operational resources compared to the manual procure-to-pay process previously in place.

This transformation is enabled by the Nipendo Supplier Cloud platform, which allows organizations to electronically collaborate with all of their trading partners while enabling seamless integration with their ERP systems. With over 3,000 IAI suppliers using the platform and more than 90% of invoices electronic, paperless process enables dramatic error reduction, savings of up to 50%